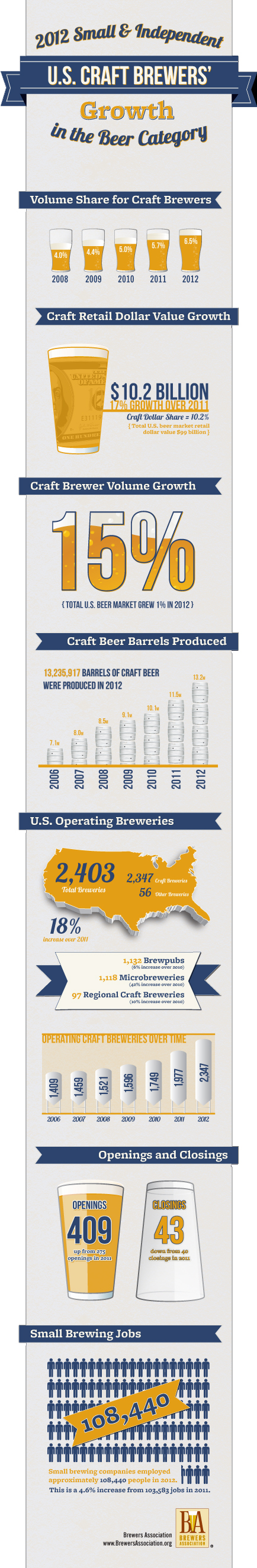

Today the Brewers Association released a report on craft brewing growth in 2012 (below). The numbers are remarkable. In 2012, the craft segment of the beer market saw a 15 percent rise in volume and a 17 percent rise in dollar sales. Previously, craft beer represented 5.7 percent of overall beer sales (by volume). Today’s report shows that in 2012 the number grew to 6.5 percent of overall beer sales. It may seem like small, incremental growth, but you must consider the overall size of the beer retail market, which is valued at something obscene like $100 billion annually.

I should note that around Seattle craft beer represents about 25 percent of overall beer sales. In Portland, the number is closer to 30 percent.

What people in Washington and Oregon don’t immediately recognize is that the craft beer industry in the Pacific Northwest is already mature and just keeps ticking along, growing at its own rapid pace. Around here, craft beer is nothing new. Now the rest of the nation is starting to catch on. Virginia has 40-something craft breweries, Iowa and Alabama have something like 20 craft breweries each. The industry is growing from sea to shining sea. Cheers to that!

Volume and Sales Significantly Outpaced the Overall Market in 2012

Boulder, CO • March 18, 2013— The Brewers Association (BA), the trade association representing small and independent American brewers, today released 2012 data on U.S. craft brewing* growth. In a year when the total U.S. beer market grew by one percent, craft brewers saw a 15 percent rise in volume** and a 17 percent increase in dollar growth, representing a total barrel increase of almost 1.8 million.

With production at 13,235,917 barrels in 2012, craft brewers reached 6.5 percent volume of the total U.S. beer market, up from 5.7 percent the previous year. Additionally, craft dollar share of the total U.S. beer market reached 10.2 percent in 2012, as retail dollar value from craft brewers was estimated at $10.2 billion, up from $8.7 billion in 2011.

“Beer is a $99 billion industry to which craft brewers are making a significant contribution, with retail sales share hitting double digits for the first time in 2012,” said Paul Gatza, director, Brewers Association. “Small and independent brewers are consistently innovating and producing high quality, flavor-forward craft brewed beer. Americans are not only responding to greater access to these products, but also to the stories and people behind them.”

In 2012, there was an 18 percent increase in the number of U.S. operating breweries, with the total count reaching 2,403. The count includes 409 new brewery openings and only 43 closings. Small breweries created an estimated 4,857 more jobs during the year, employing 108,440 workers, compared to 103,583 the year prior.

“On average, we are seeing slightly more than one craft brewery per day opening somewhere in the U.S., and we anticipate even more in the coming year. There is clearly a thirst in the marketplace for craft brewed beer, as indicated by the continued growth year after year,” added Gatza. “These small breweries are doing great things for their local communities, the greater community of craft brewers, our food arts culture and the overall economy.”

Note: Numbers are preliminary. A more extensive analysis will be released during the Craft Brewers Conference in Washington, D.C. from March 26-29. The full 2012 industry analysis will be published in the May/June 2013 issue of The New Brewer, highlighting regional trends and sales by individual breweries.

*The definition of a craft brewer as stated by the Brewers Association: An American craft brewer is small, independent, and traditional. Small: Annual production of beer less than 6 million barrels. Beer production is attributed to a brewer according to the rules of alternating proprietorships. Flavored malt beverages are not considered beer for purposes of this definition. Independent: Less than 25 percent of the craft brewery is owned or controlled (or equivalent economic interest) by an alcoholic beverage industry member who is not themselves a craft brewer. Traditional: A brewer who has either an all malt flagship (the beer which represents the greatest volume among that brewers brands) or has at least 50 percent of its volume in either all malt beers or in beers which use adjuncts to enhance rather than lighten flavor.

** Volume by craft brewers represent total taxable production.