For seriously afflicted beer geeks, one of the most interesting beer-related semiannual reports is the hop acreage report from the U.S. Department of Agriculture’s National Agricultural Statistics Service (USDA-NASS). Casual beer aficionados are content to hear a simple synopsis of the news, like, “farmers planted more hops in 2015,” but some of us yearn for more details.

So let’s get to it. Admittedly, my review of the information is pretty rudimentary and much of it comes from information provided by the Brewers Association. To begin with, here is the USDA’s high level summary from the report.

Hop Acreage in Northwest Region Up 16 Percent for 2015

Area strung for harvest in 2015 for Washington, Oregon, and Idaho is forecast at 43,987 acres, 16 percent more than the 2014 crop of 38,011 acres. If realized, this will be the third highest total harvested acreage on record. Washington, with 32,205 acres for harvest, accounts for 73 percent of the United States total acreage. Oregon hop growers plan to string 6,807 acres, or 16 percent of the United States total, with Idaho hop growers accounting for the remaining 11 percent, or 4,975 acres strung for harvest. Acreage increased in all three States from 2014 and, if realized, both Washington and Idaho acres will be at record high levels.

The 2015 hop crop has been reported as very good, with normal pest and disease pressure. In Washington’s Yakima Valley, growers utilized efficient drip irrigation systems to conserve water and were supplementing reduced irrigation district supplies with groundwater. Growing areas in Idaho and Oregon have adequate irrigation water.

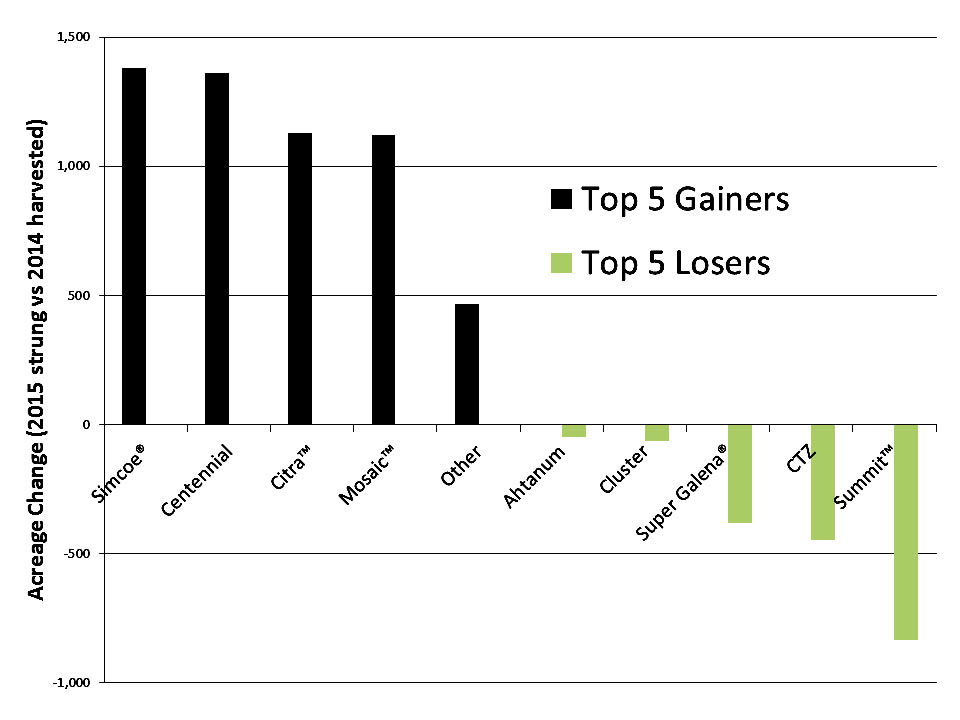

In short, the report shows an increase (16%) in acreage between the 2014 harvest and 2015 plantings; however, digging deeper into the nuts and bolts of the report reveals a strong, continued shift toward the most coveted aroma varieties. In all, aroma hop acreage grew by nearly 7,000 acres, or nearly 26 percent. Simcoe, Centennial, Citra and Mosaic led the way in terms of increased acreage.

The Brewers Association recently conducted a series of hop surveys asking brewers which hop varieties would they have purchased more of last year had the varieties been available. Simcoe, Centennial, Citra and Mosaic were four of the top six. In other words, many breweries reported that they couldn’t get enough of those varieties and would have bought more if they were available.

Demand Driven Production

The fact that hop growers and suppliers are so dialed into what the craft beer industry wants is good news for beer drinkers. Breweries tend to produce the kinds of beers we want to drink.

Why the interest in aroma hops? Simply put, demand drives production. As much as hardcore beer snobs might snub their noses at IPA, and think that the IPA craze is a thing of the past, it is still a remarkably fast growing segment of the market. The Brewers Association reports that IPA sales are up another 42% YTD in scan data.

Not surprising, as the acreage dedicated to aroma varieties increased, the acreage dedicated to dual-purpose alpha varieties decreased. The report showed that alpha acreage dropped by 1,350 acres. There are some economic factors for this decline that I won’t pretend to understand, including the fact that Germany continues to offer cost-friendly alpha varieties to the American market. Or something like that. (read the report.)

Regardless of the details, the rise of aroma varieties is still remarkable. This year 77 percent of the hop acreage is dedicated to aroma varieties. Compare that to 2009 when 69 percent of the hop acreage was dedicated to alpha varieties.

Blame it on the Rain

In his review of the hop acreage report, Bart Watson (Chief Economist for the Brewers Association) commented on the potential impact of drought and climate change. “Although I would summarize the acreage numbers as exactly what brewers (collectively) wanted to see (though individual brewers may be various levels of pleased), the yield question is huge,” Watson said.

The fear is that less water for irrigation could lead to lower yield (pounds produced per acre, basically). “A low yielding crop could easily swing a five million pound projected increase (over 2014) to a five million or – in worst case scenarios – ten million pound decrease. You don’t have to be an economist to guess what spot prices and future contracts would look like given that scenario. In addition, long term water issues could have devastating effects on the ability of new plantings to mature.”

Nearly all of the USA’s hop crop comes from the Pacific Northwest, so climate issues here impact the entire brewing industry. One way to mitigate that risk is to start growing hops in regions that are not facing droughts, or the immediate threat of droughts. Michigan currently has about 400 acres planted and another 400 acres on the way. Watson says that in the short term, that offers little assurance.

“In the grand scheme, a few thousand acres here and there do very little in a hop market if the 44,000 acres in WA, OR, and ID see serious shocks,” he said. “In the longer run, there is more hope that new regions will lower systemic risk, but until new hop regions prove they can produce significant quantities of hops at the quality level of the Pacific NW as well as avoid disease pressures of their own (it’s pretty humid in Michigan…) those hopes are theoretical.”

Some of you understand the hop industry a lot better than me, and I encourage you to comment. This was just my effort to summarize what Bart Watson explained in his review of the report.

Click here to read the complete review of the Hop Acreage Report on the Brewers Association website.

It makes sense that growers are responding to craft needs, because while the BA statistics have craft at 11% market share by barrelage, we use so much more hops than macros. My back of the envelope poorly researched rough estimate is something like 50% of hop production goes into craft beers. With craft growing, that number might move toward a point that macro hops are a byproduct of growing craft hops.

When I look at recent hop reports I see a success of communication between brewers and growers. Growers are investing in the acreage, processing equipment, and varieties that craft brewers want to use. They are going at it as hard as the brewers are.

Water is a bit of a wild card, and there is competition among brewers for specific varieties, so we’ll have to wait and see how those work out. But I do think the brewing and growing sides of the hop market have a good symbiotic relationship right now.